Projects

Economics of Kashagan

Murat Temirkhanov, Asan Kurmanbekov, Halyk FinanceThe economics of Kashagan oil and gas project development and its impact on the economy of Kazakhstan sparked a lot of interest recently. Unfortunately, the terms of the production sharing agreement (PSA) of this project are confidential, the exact sum of investments and other details of the execution of the project is unknown as well. However, based on the information from publicly available sources and on statements by officials in relation to this project, we have attempted to assess the current state of the project and its impact on the economy.

Due to the lack of official information, we cannot guarantee the accuracy of our estimates. However, in our opinion, this analysis gives enough information to get an idea about factors that have the greatest influence on the project. The basis of our calculations were conditions of the production sharing agreement, described in the Harvard Business School document – Case Study “The Kashagan Production Sharing Agreement” (http://www.hbs.edu/faculty/Pages/item.aspx?num=44755).

Short Resume

The key assumptions in our analysis were the price of oil, the amount of investments in the project, as well as scheduled work on the next phases of the project.

Given the negative trends in the global economy and the oil market, we hypothesized that by 2025, the Brent price slowly grows to $60 per barrel and then will remain unchanged until the end of the project (2044).

For our analysis, we have made the assumption, that the first phase of the project, out of the three planned, is complete, which can give the maximum level of production of 350 thousand barrels of oil per day after three years from the start of production. We assumed that the amount of investments for the first phase of the project is approximately $50 billion, $46 billion of which is reimbursed in line with the production sharing agreement.

We would like to stress that originally estimated cost of the first phase (1997) amounted to $10.3 billion. Then, starting from 2005, the launch of production was delayed several times, so the estimated value of the initial phase has grown to $46 billion in 2012. At the same time, experts indicate that the increase in the cost of the project occurred not by the fault of the engaged parties, but because of the complexity of the oil deposit itself, which became obvious as the oil deposit development progressed.

Project participants, as of today, did not make any statements regarding the commencement of work on the second and third phases of the Kashagan project. After prolonged process of project implementation and the weak growth prospects of oil prices, independent experts are quite skeptical about the continuation of the project in the current environment. In this regard, we did our analysis on the assumption that the second and third phases will not ensue and all $50 billion project costs relate only to the first phase.

Based on the aforementioned assumptions, from the participants’ point of view, the IRR of the project in the first phase turned up to be very low, 4.2%. Although, based on the terms of the PSA, the minimum acceptable rate of IRR for the participants of the project is equal to 12.5%.

For the government, the nominal payback period on approved investment will take 14 years, including 2016. Starting from 2030 and onwards (after the nominal payback), the first improvement in division of the extracted oil in favor of the State will come into force, resulting in a profit oil share increase from 20% to 45% (see detailed description of the terms of PSA below).

The PSA has other triggers that should increase the government’s share of the oil produced. A trigger associated with the surplus of receipts over recoverable expenditures (1.4 times), based on our estimate, will become effective from 2031. After that, the State’s share in the profit oil will gradually increase from 10% in 2030 to 74% in the last year of the project (2044).

Based on the aforementioned data, we assess the contribution of Kashagan in GDP growth at around 0.7pp on average in 2017-2019. Then, when oil extraction stabilize at a maximum level, the contribution of Kashagan in the GDP growth will decrease dramatically.

The projected gross revenues minus operating expenses (excluding interest expenditures) are included in the calculation of contribution to the GDP growth. However, taking into account the recoverability of investment and profit repatriation by foreign parties, the real contribution of Kashagan to the economy will be significantly smaller.

According to our calculations, taking into account the debt repayment related to the project by NC KMG in 2017-2019, a share of 21% out of all proceeds from the Kashagan project (subject to income from the share of NC KMG) will stay in Kazakhstan. After NC KMG repays its debt, 32% of the revenue from the project will stay in Kazakhstan. A first trigger stipulated in the PSA comes into effect in 2030 and will lead to immediate growth of share to 39%. After one year, a special scale for the second trigger provisioned in the PSA will be enforced. As a result, the total share of Kazakhstan in the project will gradually grow from 39% in 2031 to 55% in 2044. After 2044, all oil from the Kashagan project will be the State’s revenue.

History of the project

Based on the available Soviet geophysical data, the Government of Kazakhstan in 1992 organized the presentation of tenders for promising hydrocarbon areas including the Kazakhstan’s sector of the Caspian Sea in Houston and London. Dozens of companies have expressed interest in participating in the projects in the Caspian Sea, but later in 1993, it was decided to create an international consortium to conduct exploration, represented by such companies as Mobil, Shell, Agip, British Gas, Total and alliance between Statoil and British Petroleum, operator of the project became the company named "KazakhstanCaspyiShelf”.

After completion of the exploration studies carried out in 1994-1997, by the results of the negotiations between the consortium members and the Republic of Kazakhstan, production sharing agreement was signed. In order to conduct exploration and production of hydrocarbons, an international consortium to develop offshore fields of Kazakhstan – Offshore International Operating Company (OKIOC) was established in 1998. All members of the international consortium for the exploration of the Caspian shelf "KazakhstanCaspiyShelf" entered in the new company with proportionate shares of participants. Kazakhstan was represented by the national oil company – Kazakhoil.

A year after start of the drilling, in 2000, the high reserves of the Kashagan were confirmed. The field is located 80 km from Atyrau in the coastal zone of the Caspian Sea. Geological reserves of the Kashagan project constitute 5 448 million tons, with 1 694 million tons recoverable. The quality of oil is high enough (45° API), but contains hydrogen sulphides and mercaptans. By its characteristics Kashagan oil, like Tengiz oil, falls into the category of "Light sweet", but contains more gases. The deposits are 130 km apart, with distinction that Kashagan is offshore.

Annex 1 lists the changes over time of the project’s participants.

Investments and oil extraction schedule

Table: 1. Investments and Kashagan’s productivity

|

|

Cost ($ bn) |

Production (th. bbl./day) |

||||

|

Original 1997 |

Revised 2008 |

Revised 2012 |

Original 1997 |

Revised 2008 |

Revised 2012 |

|

|

Phase 1 |

10.3 |

19.0 |

46 |

300 |

370 |

370 |

|

Phase 2 |

18.7 |

117.0 |

? |

300-900 |

300-900 |

? |

|

Phase 3 |

Up to 1 200 |

Up to 1 770 |

? |

|||

|

Total |

29.0 |

136.0 |

? |

|

|

|

Source: Harvard Business School Case Study “The Kashagan Production Sharing Agreement”, the media

In line with the production sharing agreement signed in 1997, investments in the first phase of the Kashagan project were set at $10 billion and $19 billion for the second and third phases. First oil was expected to be produced by 2005.

In 2002, the Consortium asked the Government about production delay until 2008. For the delay of commercial production at the field, the Government imposed a fine of $150 million on the Consortium in 2004.

In 2007, the project’s operator initiated amendments to the agreement due to another postponement of the start of production from 2008 to 2011 and increase of the budget of the project to $136 billion. The negotiations lasted for more than a year and at the end of 2008 culminated with the amendment to the agreement providing for the postponement of production until 2012 and sale by participants of 8.48% of the project to NC KMG on pro-rata basis for $1.8 billion, with future settlements from extracted oil.

At the same time, the receipt of royalty by the Government was included in the agreement at 3.5% given the price of oil was over $45 per barrel. The size of the penalties for delay of commercial production amounted to $120 million for each year of the delay. The media also aired new maximum production capacity under the first phase at 370 thousand barrels per day.

In 2012, NCOC sent to the Government of Kazakhstan a new proposal to increase the cost of the first phase to $46 billion. We do not know whether that proposal was accepted. In a press release dated June 30, 2013 project operator disclosed the amount of realized investments in the first phase of the project in the amount of $40.6 billion.1

Oil production at Kashagan started in September 2013, but due to the defects of pipes, which demanded replacement

(200 km in total), the production was stopped. As reported by Reuters, the cost of replacing the tubes was estimated at $1.6 to $3.6 billion.2 In accordance with the NCOC shareholders' agreement with the government of Kazakhstan, the initial expenses for constructing pipelines were classified as non-refundable within the PSA.

Oil production at Kashagan resumed this October. According to the government officials, production corresponds to the commercial level of 75 thousand barrels per day which was reached on November 1. Overall production is expected to exceed 1.1 million tons this year.

There is no official figure for the amount of realized investments made to date in the Kashagan project. Nevertheless, the evaluation of various experts agrees that the total investment to date is a little more or a little less than $50 billion. Part of these costs, for example, replacement of pipes, are non-refundable under the PSA.

Terms of Production Sharing Agreement

Production sharing agreement is one of the forms of foreign direct investment, where a foreign investor carries out contract based investing, the costs are reimbursed from revenue, then, in accordance with the terms of the contract, the profits are divided. As an example of the large PSA, the Tengiz PSA and Karachaganak PSA can be noted.

Annex 2 provides a direct citation of Kashagan PSA terms that were described in the Case Study "The Kashagan Production Sharing Agreement". These terms of the PSA were in effect in 2007. Further changes in the conditions we tried to reconstruct on the basis of statements by officials in the media.

In a widely used practice, a PSA typically contains four major provisions. First, a consortium agrees to pay the government a royalty based on gross production volume. After the royalty is deducted, a consortium is entitled to a pre-determined share of production to compensate for capital expenditures and operating costs—this share of the output is known as the “cost oil”. The remaining production, the “profit oil”, is then shared between a host government and a consortium at a pre-determined rate. Finally, a consortium has to pay income tax on its share of the profit oil. In this case, after the Consortium recovers initial investment entirely, the proportion between "profit oil" and "cost oil" usually changes upwards towards “profit oil” and increase in the government share of production sharing.

The Kashagan PSA addressed the four key provisions found in most PSA’s. By our understanding, the production sharing is as follows.

The initial production sharing occurs by the application of royalty for the whole volume of the extracted oil. The size of the royalty starts at 3.5%, when the price of oil is over $45 per barrel. If the price is below this level, the royalty is not charged.

After deducting the royalty, Consortium gets 80% of its production (cost oil) to cover the initial costs of exploration and development, as well as ongoing operating costs. After reaching a nominal payback on the initial investments, the figure for cost oil is reduced from 80% to 55%.

The remaining output (profit oil) is originally divided between the State and the consortium, the government takes 10% and 90% goes to the Consortium. As the oil production progresses, the three triggers are tracked, whereby the State’s share in the profit oil gradually increases from 10% to 90% as the triggers start working. Below is a brief description of these triggers. A detailed description is given in annex 2.

-

Internal rate of return (IRR). The State share in the profit oil remains 10% while the IRR of the project is less or equal to 17%. If IRR changes from 17% to 20%, the share of the State is changed from 10% to 90% as IRR increases. If the project IRR exceeds 20%, the State share in the profit oil remains unchanged at 90%.

-

The volume of extracted oil (Project Volume). The State share in the profit oil remains 10% while the amount of oil is less than or equal to 3 billion barrels. If the volume of extracted oil moves from 3 billion to 5.5 billion barrels, the State share varies from 10% to 90%, in connection with increases in production volumes. At the same time, the increase in the proportion of State depends on the predetermined scales, linked to the IRR of the project. Thus, when the project IRR is below or equal 12.5%, the State share in the profit oil may not exceed 60%, regardless of the total volume of the extracted oil. 90% can be achieved only when the project IRR is greater than 17.5%.

-

Nominal payback (R-factor or RF). The State share in the profit oil remains 10% while the sum of all cash receipts of consortium members is less than all capital and ongoing operating cash costs multiplied by a factor of 1.4. An excess of cash receipts over the costs of the project vary from 1.4 to 2.6 times, State share varies from 10% to 90% as revenue increases. After the ratio of receipts to expenditures exceed 2.6 times, the State share in the profit oil capped at 90%.

In addition, depending on the project IRR the State charges the income tax on the consortium’s share of profit oil from 30% to 60%. If IRR is less or equal to 20%, the tax is 30%. If IRR of 20% to 30%, the tax varies from 30% to 60% as IRR increases. After the project IRR exceeds 30%, the tax is capped at 60%.

Besides production sharing between the State and the consortium, the State has a stake in the consortium through NC KMG (16.88%).

Assumptions

Project period is until the end of 2044.

Investments in the first phase of the project are $50 billion, $46 billion of which are reimbursed by the PSA.

The price of Brent will slowly grow to $60 per barrel by 2025 and then will remain unchanged until the end of the project.

Production gradually reaches 350 thousand barrels per day by the year 2019, and until the end of the project will remain unchanged.

Operating expenses are taken at the level of 25% of the revenues. As a reference, the share of Tengizchevroil respective costs were taken. Interest expenses are calculated at 6% rate.

The local content is taken at the level of 40% based on the respective indicator for Tengiz (32%) and Karachaganak (49%). The share of local content is taken into account when calculating the share of operating costs that will remain in Kazakhstan.

To calculate NPV the rate of 12.5% was used. We believe it is the lowest acceptable for participants of the Consortium, based on triggers for the revenue sharing described in PSA.

NC KMG will pay out a debt to a consortium in the amount of $1.8 billion from its revenue share in the project.

Calculations

In accordance with the assumptions and terms of PSA listed above, the IRR of the project equals to 4.2%.

At a discount rate of 12.5%, the NPV of the project is negative at -$18.9 billion. According to our calculations, to achieve the IRR of 12.5%, long-term oil price instead of $60 per barrel (as in our assumptions) should be 250 dollars in 2017-2044.

Under the long-term oil price of $60 per barrel, even in case of extension of the agreement on production sharing to infinity IRR will be significantly lower than 12.5%.

On the basis of the assumptions, the nominal payback of approved investments in PSA ($46 billion) takes 14 years, including 2016. Starting from 2030 and onwards (after the nominal payback), first improvement of produced oil sharing in favor of the government will occur, resulting in a profit oil of the project increasing from 20% to 45%.

A trigger associated with the surplus of receipts over expenditures (R-factor) will become effective from 2031. After that, the State’s share in the profit oil will gradually increase from 10% in 2030 to 74% in the last year of the project (2044).

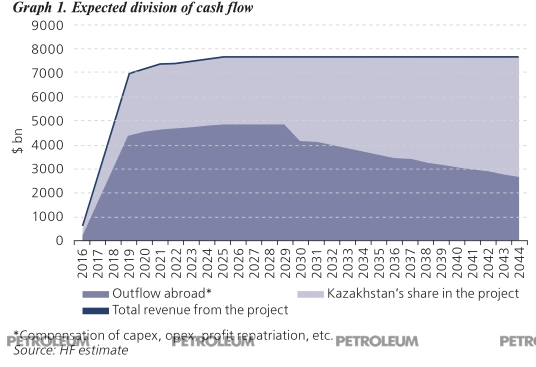

On the basis of our calculations, we tried to estimate the share of produced oil, which would go abroad irretrievably as recoverable costs from the project, in the form of profit repatriation, and partly the operating expenses, paid to foreign contractors. Revenues from the NC KMG share in Kashagan project we consider as government revenue.

According to our calculations, taking into account the debt repayment of NC KMG ($1.8 billion), 21% of the all proceeds from the Kashagan project (taking into account the share of NC KMG) it will stay in Kazakhstanin 2017-2019. After the NC KMG’s debt gets repaid, 32% of the revenue from the project will remain in Kazakhstan in 2020-2029. A first trigger stipulated in the PSA comes into effect in 2030 and will lead to immediate growth of share to 39%. After one year, a special scale for the second trigger provisioned in the PSA will be enforced. As a result, the total share of Kazakhstan in the project will gradually grow from 39% in 2031 to 55% in 2044. After 2044, all oil from the Kashagan project will count as State revenue.

Graph 1. Expected division of cash flow

Graph 1. Expected division of cash flow