Markets

The Benefits of a Hydrogen Industry in Kazakhstan

Yerdaulet Abuov, Daulet Zhakupov, Botakoz Suleimenova, Bekbol Ismagulov, Alisa Kim, Saule Zholdayakova

Department of Alternative Energy, KMG Engineering, Hydrogen Technologies Research Laboratory, Astana/Atyrau

The prospects of hydrogen energy in Kazakhstan are mainly seen from an export-oriented perspective. There has been limited progress toward developing hydrogen-end use in Kazakhstan. However, there is a long-term vision on hydrogen end-use in the industry, transport and power sectors of Kazakhstan. Owing to the existing use of hydrogen in the chemical sector and refineries, these two were categorized as near-term end-use areas.

Energy transition in Kazakhstan and hydrogen

Energy and climate policy conditions for the emerging hydrogen industry in Kazakhstan

Kazakhstan plans to become carbon-neutral by 2060 and the key initiatives of this path are consolidated in the Carbon-Neutrality Strategy, officially accepted on February 2nd 2023 [1]. The document proposes a by-industry approach when dealing with decarbonization. Besides covering different social and economic aspects, the Strategy also focuses on the potential technologies and R&D development. Therefore, CCUS, bio- fuels and hydrogen utilization, and increased use of renewables are the main drivers for future sustainable development.

However, a detailed evaluation of the document did not show the concrete applications of the above-mentioned technologies leaving the question about the timescale and approach of low-carbon hydrogen utilization for the future regulations and roadmaps of the different stakeholders, mainly governmental organizations, businesses, and society. The present vision of the Strategy is summarized in Table 1.

| Table 1 - Vision for Kazakhstan's Economic Decarbonization. | ||

|

Industry |

Current Situation (2023) | Carbon Neutrality (2060) |

| Power Generation | Dominance of coal | Alternative and Renewable Energy, CCS |

| Transport | Dominance of petroleum products | Electricity, Hydrogen, Biofuel |

| Buildings | Reliance on coal and natural gas for heating systems | Electrification, Increased Energy Efficiency, Heating from Alternative and Renewable Energy Sources |

| Industry | High demand for fossil fuels | Electrification, Increased Energy Efficiency, Hydrogen, CCS |

Having a vast amount of low-cost fossil fuel resources, Kazakhstan cannot rapidly shift to low-carbon development. The study indicated the three main drivers of the hydrogen economy in Kazakhstan: decarbonization, export potential, and energy security. The capability of blue hydrogen production on giant oil & gas fields was evaluated in the review article (“Hydrogen Prospects of Kazakhstan”, Petroleum No.1-2023).

Regarding green hydrogen production, the deployment of giga-scale projects requires a substantial amount of water to be available and renewable electricity production on-site and/or renewable electricity transmitted from high-supply regions. There is a significant correlation between the annual operating hours of electrolyzers and the cost of green hydrogen. There are several recent studies exploring low-carbon hydrogen production options in Kazakhstan.

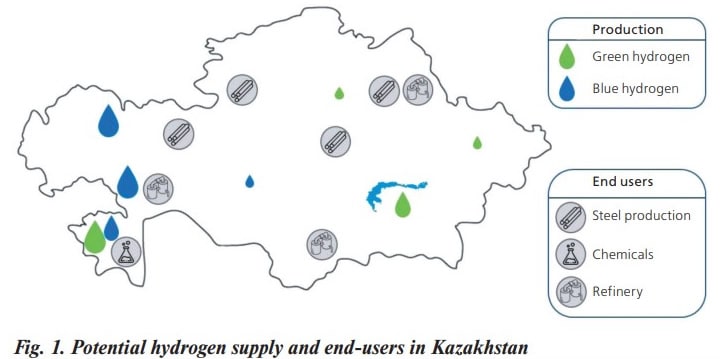

Previous analysis has shown that geo-conditions in Kazakhstan allow developing operating hours up to 5700 h/ year and 1600 h/year for wind and solar electricity, respectively. Yet water scarcity is a challenge in Central Asia. Three of eight water basins in Kazakhstan are subjected to water scarcity. The amount of water used by green hydrogen at the national scale seems to be not significant, but water use by the hydrogen industry at the basin scale remains unclear. A comprehensive study of the water basin in the area is crucial before implementing low-carbon hydrogen production in Kazakhstan. Despite these obstacles, two locations are candidates for large-scale green hydrogen production in Kazakhstan: the Mangystau region bordering the Caspian sea and the Qaraghandy region along the Balkhash Lake.

Additionally, Yertis and Nura-Sarysu water basins coupled with wind energy also can be used for small-scale green hydrogen production (see Fig. 1). Regarding blue hydrogen production, regions in the west of the country would enable the production of blue hydrogen given the available natural gas resources and the sedimentary basins with a high potential for CO2 storage. Major blue hydrogen projects are most favorable to be implemented in Atyrau, West Kazakhstan, and Mangystau regions (see Fig. 1). In terms of gas reserves, the country is among the top 20 in the world, yet pricing policy and the monopoly in the gas sector create artificial resource deficiency and might hinder the deployment of blue hydrogen without appropriate mitigation strategies. The same water-related limitations of green hydrogen apply to blue hydrogen, as it has a similar water consumption rate.

Fig. 1. Potential hydrogen supply and end-users in Kazakhstan.

Fig. 1. Potential hydrogen supply and end-users in Kazakhstan.

So far, the country mainly relied on renewable energy and increased the use of natural gas. To move towards hydrogen- based decarbonization, it was found essential to conduct a full analysis of the GHG emissions profile represented by the Emissions Trading System (ETS).

The local ETS was completely launched in 2018. The operating principle is based on the distribution of free quotas between the emission sectors, namely the energy sector, metallurgy, oil and gas, mining, chemical industry, and production of construction materials (lime, cement, brick, and gypsum production). The transport sector is out of the system's scope. According to the Environmental Code, starting from 2021 to stimulate the decarbonization initiatives, there is a reduction of the free quotas for 1.5% on a yearly basis, and industrial players should buy the cap for extra emissions in the stock market. Currently the price for an additional quota is 1.1 USD per ton of CO2 eq.

To identify the individual sector contribution in the country-wise GHG profile, the data describing free quotas distribution was processed for the time between 2018 and 2025. Results are summarized in Table 2. As can be observed, power generation is the primary emitter of GHG in Kazakhstan with around 57% contribution, while metals production (18.6%) and oil & gas (13.96%) sectors take the second and third places respectively. It should be noted that at the present time, the permanent monitoring of the plants' emissions profile and volumes is still under development and consequently data presented does not represent the country's full pollution profile.