Petrochemistry and oil refining

Modernization 2.0

ABOUT THE AUTHOR

Askar Ismailov, a majority of his career was involved in oil and gas industry. He began his career in 2002 at the Karachaganak field. He also took part in the execution of SGP/SGI projects of the Tengiz field as well as in Kashagan. International experience is represented by the project Shah Deniz Stage 2 and the Southern Gas Corridor, which includes the South Caucasus Pipeline (Azerbaijan-GeorgiaTurkey), the TANAP Pipeline (Turkey) and TAP (Greece-Albania-Italy). Experience in leading oil and gas companies such as Eni, ConocoPhillips, Lukoil and also in SWF «Samruk-Kazyna».

In April of this year, the Ministry of Energy of the Republic of Kazakhstan announced plans to modernize three major refineries and a smaller bitumen plant.

The Ministry of Energy's plans include increasing the country's total oil refining volumes from 18 mln to 27 mln tons per year, partly through projects to increase the capacity of refineries and, consequently, the depth of oil processing:

- Shymkent Refinery – from 6 to 12 mln tons/year;

- Pavlodar Petrochemical Plant – from 5.5 to 8 mln tons/year in two stages;

- Caspi Bitum – from 1 to 1.5 mln tons/year;

- Atyrau Refinery – by 0.7-1 mln tons/year of secondary oil refining capacity.

Unfulfilled Promises

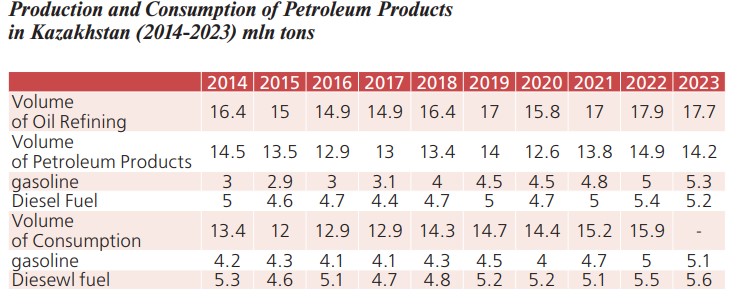

A few years ago, the national company KazMunayGas (KMG) and the Ministry of Energy claimed that the modernization of three Kazakhstani refineries would solve the fuel shortage problem in Kazakhstan, and there would be no more fuel deficits in the domestic market. The expensive consulting company Boston Consulting Group (BCG) was brought in. Arguments were made that the republic's automotive market would not grow to the extent that large volumes of fuel would be needed, leading to the decision to abandon the construction of a fourth refinery. Approximately $6.3 bln was invested in the modernization of the existing refineries.

What do we have today? The deficit remains a pressing issue. The demand for fuel continues to grow despite the bold statements from KMG, the Ministry of Energy, and BCG. Therefore, the news about additional modernization sounded like repeating the same mistakes.

According to the ministry, based on recommendations from another foreign consultant, IHS Markit, the current fuel deficit will be covered by another modernization. Once again, the construction of a fourth refinery has been abandoned.

I've been saying we need a new refinery designed with petrochemical installations in mind for years. Refinery modernization is money down the drain! The Chinese (CNPC, KMG's partners in PKOP) understand this, which is why they are not active in modernizing the Shymkent Refinery. All news about "roadmaps" and so forth comes only from the Kazakhstani side. Why is CNPC silent?

The answer is simple. The Chinese Communist Party has ordered a reduction in the country's oil refining volumes, causing local refineries to operate at 70-80% of their design capacities. So why would they invest in oil refining in other countries?! Moreover, the issues with raw materials for PKOP have not been resolved. In the Kyzylorda region (the leading supplier of raw materials), oil production has fallen threefold. Yet they propose increasing capacity to 12 mln tons per year. It's a paradox! I'm confident there will be no modernization at PKOP. The pragmatic stance of the Chinese side will become evident. Therefore, we can forget about increasing PKOP's capacity.

The Atyrau Refinery is colloquially said to be "a hundred years old." Residents complain about its environmental impact. Emergency shutdowns have become part of its operations. In September 2019, there was even a catalyst release at the catalytic cracking unit, essentially the heart of the refinery.

What is the state of the safety systems at the units? In the event of a major accident at these outdated facilities, Kazakhstan could suddenly lose 30% of its refining capacity. This would lead to an even more detrimental deficit for Kazakhstan's economy. The minimal changes at the Atyrau Refinery indicate the critical condition of the production facilities and the infrastructure, directly affecting the city's environment.

Personnel is Everything

The Ministry of Energy notes that the existing refineries have qualified and experienced personnel with expertise in modernizing and commissioning new facilities. Apparently, the Ministry is unaware of the problems at Kazakhstani refineries. For years, refinery leaders have been talking about a personnel shortage. As one refinery manager officially admitted: “We cannot compete on this issue with oil enterprises. We are experiencing a significant outflow of experienced employees to other enterprises because they are offered salaries 1.5-2 times higher than ours.”

The “Intern” program launched by KMG does not solve the current problems. The majority of participants in the project are college and university graduates from 2019-2023, meaning they have no experience working at refineries. I think it goes without saying to the Ministry of Energy that commissioning work requires highly qualified specialists.

There is a lack of continuity in the industry. A generation of Kazakhstani refiners is leaving: some are retiring, some due to health reasons, and some have been pushed out of the system as representatives of the Old Kazakhstan. This means that Kazakhstani refining is now in a situation where there is no layer of specialists to train the newcomers from the “Intern” program. Therefore, thinking that another round of modernization will be successful would be reckless. This is despite the fact that there are still many questions about the previous modernization.

Neighbors Will Help

The possible sale of Kazakhstani refineries to Russian companies is increasingly being discussed. The main contenders are Lukoil, which reopened its gas stations in Kazakhstan after almost a 20-year hiatus, and Gazprom Neft, which owns the Omsk Refinery near the Pavlodar Petrochemical Plant. Previously, there was an unsuccessful attempt to transfer the Atyrau Refinery to the trust management of Russia's Tatneft.

The intentions were so serious that the Atyrau Refinery sent its employees to Tatarstan to familiarize themselves with the Taneco Refinery, owned by Tatneft. However, for several reasons, the parties did not reach an agreement. Nevertheless, selling refineries to Russians is actively discussed in the Kazakhstani information space.