Projects

Development of carbon regulation in Kazakhstan and carbon price disclosure

Since Kazakhstan ratified the Paris Agreement, the government has gradually strengthened its position on climate change issues by revising environmental legislation and considering the launch of various instruments aimed at decarbonizing the country.

The Government of Kazakhstan is committed to decarbonizing the country, and the main mechanism for achieving this is carbon regulation and carbon pricing, which is also crucial for potential investors in planning their portfolios in the Kazakhstan market. According to EY's Global Survey "How can corporate reporting bridge the ESG trust gap?", today 99% of surveyed investors consider companies' ESG disclosures in the investment decision-making process, including 74% of respondents who use a rigorous and structured approach. For comparison, in EY's 2018 global survey of institutional investors, only 32% of surveyed investors used a stringent approach.

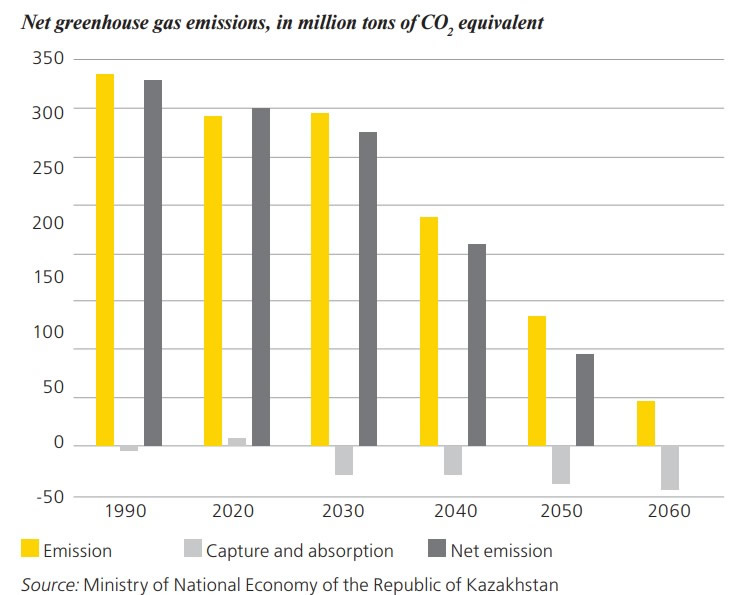

Thus, after the publication of the updated Environmental Code of the Republic of Kazakhstan, the government approved the Strategy for Achieving Carbon Neutrality (SACN) of the Republic of Kazakhstan by 2060 and updated NDC – National Contribution of the Republic of Kazakhstan to the Global Climate Change Response. These strategic documents outline the future development vector of the country's industry and economy, with the medium-term goal being to reduce greenhouse gas emissions by 15% by the end of 2030 compared to the emission level of the base year 1990 and the long-term goal being carbon neutrality by 2060.

Net greenhouse gas emissions, in million tons of CO2 equivalent

Source: Ministry of National Economy of the Republic of Kazakhstan

Kazakhstan requires equally ambitious solutions for transforming its regulatory system to achieve its ambitious goals. Current carbon regulation consists only of a carbon emissions trading system that covers less than half of the country's GHG emissions. However, this instrument is not fully used as a market regulation mechanism since it is 100% subsidized by the state (through the issuance of free allowances). The resulting problems related to the lack of liquidity and insufficient annual GHG emissions reduction have prompted the regulator to revisit the current approaches. Thus, enforcing several aforementioned regulatory documents will revive the system as a trade one, launching mechanisms for the initial auction and a portion of paid distributed allowances, which will eventually stimulate the market to increase the carbon price, starting approximately from 2026. (For reference: the current average price in Kazakhstan is ~500 tenge per quota, while the price in the developed market of the European Union is 93 euros per quota).

The volume of carbon allowances distributed by the state approved in the National Plan for the Allocation of Greenhouse Gas Emission Allowances for 2022-2025

Regulated industry sector

|

|

Number of units | Volume of allowances for 2022, tons of CO2 | Volume of allowances for 2023, tons of CO2 | Volume of allowances for 2024, tons of CO2 | Volume of allowances for 2025, tons of CO2 | |

| Electric energy | 89 | 95 304 595 | 93 872 608 | 92 469 647 | 91 076 361 | |

| Oil and gas | 49 | 23 039 146 | 22 692 974 | 22 353 819 | 22 017 003 | |

| Mining | 21 | 7 334 212 | 7 224 012 | 7 116 047 | 7 008 826 | |

| Metallurgical | 19 | 30 747 135 | 30 285 148 | 29 832 525 | 29 383 023 | |

| Chemical | 7 | 1 715 105 | 1 689 335 | 1 664 087 | 1 639 013 | |

| Manufacturing | 14 | 8 019 802 | 7 899 302 | 7 781 244 | 7 664 000 | |

| Total | 199 | 166 159 995 | 163 663 379 | 161 217 369 | 158 788 226 | |

| Total volume | 649 828 969 | |||||

| Provision |

|

11 816 923 | 11 643 887 | 11 460 288 | 11 299 264 | |

The government is also considering alternative options to expand the impact of carbon regulation on economic sectors. For example, introducing a carbon tax in economic sectors associated with fossil fuel combustion (which is about 70 million tons of GHG emissions) that do not fall within the regulatory scope of Kazakhstan's emissions trading system. It is also worth noting that the introduction of a carbon tax in other sectors of the national inventory of greenhouse gas emissions, such as Agriculture, Waste, Land Use, Land-Use Change, and Forestry, Emissions from Unorganized Sources (fugitive emissions), is not considered due to the specific process of calculating GHG emissions and determining the correct configuration for subjecting these emissions to carbon taxes. The carbon tax and the paid portion of carbon allowances in the ETS will contribute to replenishing the so-called carbon fund, described in SACN and aimed at financing decarbonization projects in the country.

Both regulators and the business community are increasingly agreeing on the fundamental role of carbon pricing in transitioning to a decarbonized economy. After the introduction of mandatory paid allowances in Kazakhstan's emission trading system and/or the implementation of a carbon tax, the country's business community will need to use internal carbon pricing (allowances) for assessing and forecasting the impact on their operations, as well as a tool for identifying potential climate risks and revenue opportunities, which, in fact, is already being done by some of Kazakhstan's major companies that have implemented various models and methodologies for assessing internal carbon pricing.

Ultimately, long-term investors will use carbon pricing to analyze the potential impact of climate change policy on their investment portfolios, as is done in countries with developed carbon regulations. This will enable them to review investment strategies and reallocate capital to low-carbon or climate-change-resilient activities.

It should also be noted that disclosure of an internal carbon price is one of the recommendations of the TCFD reporting (Task Force on Climate-related Financial Disclosures), a reporting framework aimed at disclosing information on the financial impact of climate risks on the company's activities. These disclosures will also be included in the upcoming new IFRS S1 and S2 accounting standards, published in mid-summer 2023 and expected to become effective in 2024. Likely, these standards will gradually become mandatory for Kazakhstani companies, as IFRS standards were adopted by the Law of the Republic of Kazakhstan On Accounting and Financial Reporting. In addition, compliance with IFRS standards is required by the listing regulations of the Kazakhstan Stock Exchange and the AIX Exchange.

In this regard, given the steps taken and the ambitions of the state to strengthen carbon regulation, the possible emergence of new carbon mechanisms, stricter requirements for disclosures on sustainable development, and the growing interest in the carbon price from investors, companies need to act proactively and already begin to adapt their strategies/policies to the upcoming changes.

Article authors:

Aibek Tulepbergenov, Sustainability Services Consultant, EY Kazakhstan

E-mail: Aibek.Tulepbergenov@kz.ey.com

Tel. +7 705 919 75 20

Dauren Kabylbek, Sustainability Services Consultant, EY Kazakhstan

E-mail: Dauren.Kabylbek@kz.ey.com

Tel. +7 708 261 73 00

Supervisor:

Victor Kovalenko, EY Partner, Head of Sustainability Services in Central Asia, Caucasus, and Ukraine.

E-mail: Victor.Kovalenko@kz.ey.com

Tel. +7 777 308 10 99