Markets

Petroleum Products Market: State of Competition and Monopoly Limitation

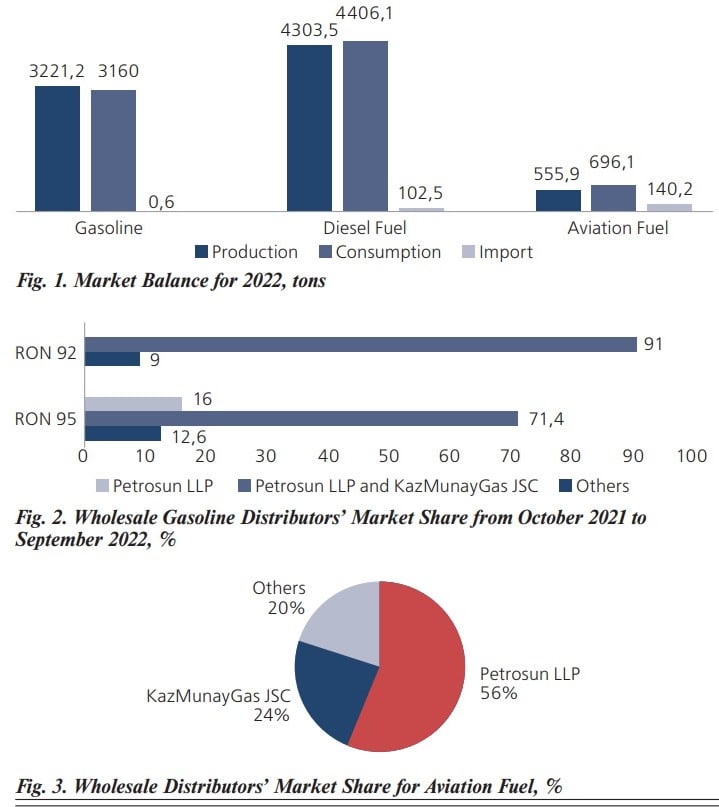

The Agency for Protection and Development of Competition of the Republic of Kazakhstan has conducted an analysis of competition in specific commodity markets and the measures taken to limit monopolistic activities for the year 2022. The final report has been submitted to the president and the prime minister of the country. The market analysis of wholesale and retail petroleum products encompasses specific types of petroleum products such as: RON 92 and RON 95 gasoline, aviation fuel, and diesel fuel.

All petroleum products are derived from raw oil prepared for processing, supplied by the same organizations. Notably, the most significant market shares belong to Petrosun LLP, KazMunayGas JSC, and Petrostar LLP:

- RON 92 gasoline: Petrosun – 58.7%, KazMunayGas – 32.6%;

- RON 95 gasoline: Petrosun – 47.3%, KazMunayGas – 24.1%, Petrostar – 16.5% (Figure 2).

Compared to the previously conducted market analysis, the number of market participants increased from 36 to 55 entities during the period from September 2021 to September 2022.

Furthermore, for RON 95 gasoline (price unregulated), there's a market de-concentration in favor of a new market player, Petrostar LLP., which holds a 16% market share. During the analysis, the price dynamics of petroleum products from two major wholesale distributors, Petrosun LLP and KazMunayGas JSC, were studied.

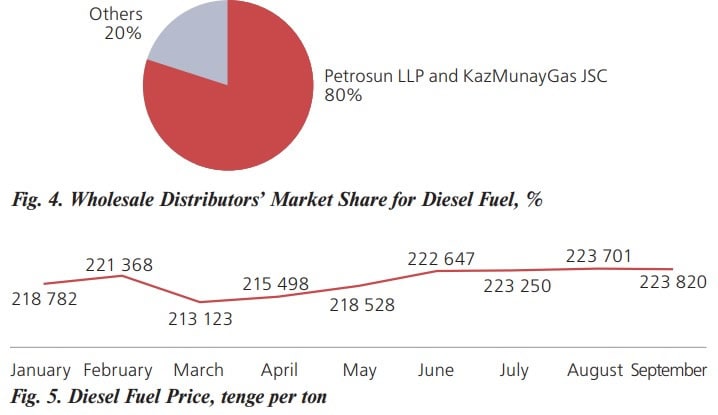

Overall, the wholesale petroleum products market is characterized as highly concentrated:

RON 92 gasoline: CR-3 (concentration index) – 91.3%.

RON 95 gasoline: CR-3 – 87.9%.

Diesel fuel: CR-3 – 81%.

Aviation fuel: CR-3 – 80.8%.

Consequently, in accordance with the Entrepreneurial Code's requirements, both Petrosun Ltd. and KazMunayGas JSC are recognized as entities holding a dominant position in the market.

Considering the new code provisions ensuring equal access to key capacities and the market shares held, the analysis concluded that the key capacity holders are Petrosun LLP and KazMunayGas JSC.