Atyrau Oil & Gas

Caspian Countries Require New Logistics Schemes for the Supply of Oil and Petroleum Products

Over 70 representatives from the oil and gas industry of Kazakhstan, Uzbekistan, Kyrgyzstan, Russia, the UAE, Azerbaijan, Belarus, the Czech Republic, Malta, and Slovakia discussed current issues in oil refining and the export of oil and petroleum products at a round table in Almaty.

Confidence Information Services organized the round table with the support of Coral Energy. The main topics for discussion were the oil and petroleum products market of Kazakhstan and Central Asia, and the prospects and logistics of export. Participants discussed the competitive advantages and disadvantages of large and mini-refineries. The discussions were moderated by a member of the Public Council of the Ministry of Energy of Kazakhstan, the General Director of Almex Polymer, Olzhas Baidildinov.

He spoke about the ongoing reform in Kazakhstan's fuel market pricing. A radical innovation was the abandonment of the tolling arrangement: refineries can now directly purchase oil from producing companies and engage in marketing of the finished oil products after processing. However, the new scheme has also shown several disadvantages. Despite slogans about market liberalization, the market continues to be regulated through a monthly oil supply plan for refineries, approved by the Ministry of Energy, through maximum prices for the sale of crude oil (about $20-25 per barrel), setting tariffs for processing and transportation, and establishing maximum sales prices for certain types of oil products. The state has yet to abandon price regulation for high-octane gasoline grades, particularly 95 RON.

This leads to periodic fuel shortages in the market despite the completion of the refinery modernization program. According to the indicative plan approved annually by the governments of the Republic of Kazakhstan and the Russian Federation, in 2023, the import of 800,000 tons of diesel fuel was planned with domestic production of 5 mln tons, 300-350,000 tons of gasoline (domestic production about five mln tons). Also, about 300,000 tons of tar are imported from a domestic output of 1.1-1.2 mln tons of bitumen, and 30-40% of aviation fuel consumption (about 800,000 tons per year) is imported.

The capacities of the three major refineries are practically 100% loaded, the new Condensate plant in the West Kazakhstan region is in a state of default, and the mini-refinery sector is regulated. In this context, the Ministry of Energy announced its intention to expand the capacity of PetroKazakhstan Oil Products (Shymkent Refinery) from 6 mln to either 9 mln or 12 mln tons per year (the final feasibility study will be approved in 2024). Meanwhile, KazMunayGas and CNPC (shareholders of the refinery) lack additional sources of raw materials for processing. The country's President instructed the government to explore the issue of supplying 5 mln tons of oil per year to the refinery from the volumes of Tengizchevroil, KPO, and NCOC.

Even if the issue can be resolved positively amid the price disparity between crude oil in the domestic and export markets, oil pipelines from the west to the south need to be expanded, as well as bottlenecks in the overloaded southern railway transport hub. Currently, the absence of price benchmarks prevents the Chinese co-shareholder of the LLP from evaluating the investment project.

Asylbek Dzhakiyev, Chairman of Kazakhstan's Petrocouncil, presented the current situation with oil production, refining, and consumption of oil products in his speech "Oil Refining in Kazakhstan: Trends and Prospects." The completed modernization of domestic refineries has increased gasoline production from 3 mln to 5.02 mln tons per year and diesel fuel production from 4 mln to 5.3 mln tons. Currently, the national company KazMunayGas is beginning to implement new investment projects at all three refineries. This includes expanding the capacity of the Shymkent plant (expected project completion in 2029), increasing the output of light oil products through deep processing of mazut at the Atyrau plant, and building a sulfur removal unit for liquefied petroleum gas at the Pavlodar refinery (completion due by 2025).

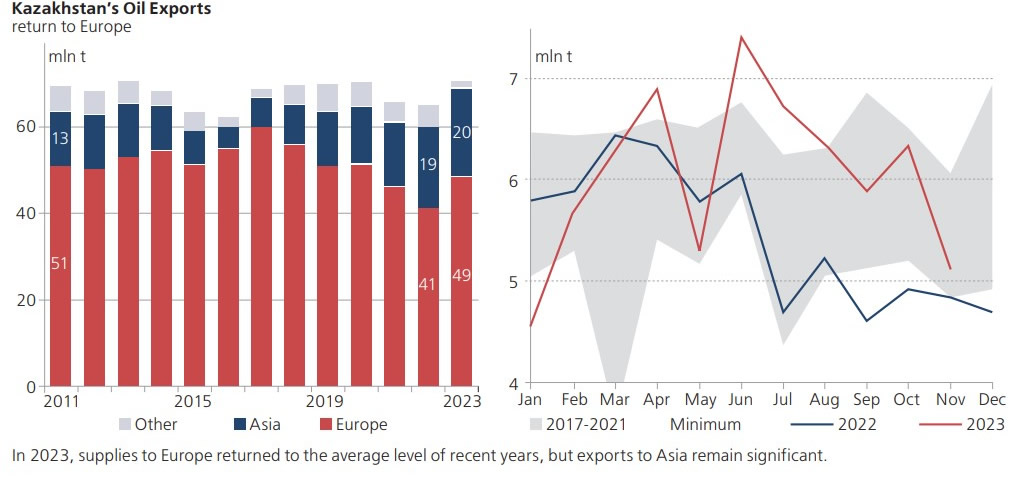

Kazakhstan❜s Oil Exports

Kazakhstan❜s Oil Exports