Projects

Kazakh Oil for the European Union. Can Europe Replace Russian Crude with Kazakhstan❜s?

KazMunayGas Invited to the Balkans

KazMunayGas and the Croatian oil transportation system operator JANAF, following the results of the first meeting of the Kazakh-Croatian intergovernmental commission on trade and economic cooperation in Zagreb earlier this year, have signed a memorandum of understanding. The document confirms the readiness of the parties to begin discussing cooperation in oil transportation and the storage of oil and oil products.

JANAF, which manages the oil terminal in the port of Omišalj on the island of Krk, the oil refinery in Rijeka, and the Adria oil pipeline system in Croatia, has declared its readiness to assist KazMunayGas in expanding the geography and volumes of oil exports to consumers in the Balkan and Eastern European countries through the "Adria" oil pipeline and Omišalj terminal.

The projected capacity of "Adria" is 34 million tons of oil annually, while the established capacity is 20 million tons. Construction of the pipeline, intended for oil supplies from the Soviet Union to the countries of the Council for Mutual Economic Assistance (CMEA) in the late 1960s, actually began in 1984, and it was put into operation in 1989, on the eve of the collapse of the socialist bloc in Eastern Europe.

Two years after the bloody war and the subsequent disintegration of Yugoslavia into several independent states, the Adria operation was halted, and its facilities were mothballed. The northern branch of the oil pipeline was reopened at the end of 1995 and has since been used intermittently, mostly in reverse mode, for pumping crude oil.

Therefore, before deciding on long-term cooperation, KazMunayGas and Croatian specialists will have to conduct a full technical audit, assess which infrastructure sections need to be restored, repaired, or modernized, and, most importantly – decide who will pay for these works.

Only after this can a decision be made about whether oil from Kazakhstan will go to Croatia, Hungary, Serbia, Slovenia, Bosnia, and Herzegovina, which have been feeling the impact of anti-Russian sanctions for the last two years.

Russian Oil Under Ban

The European Union implemented a ban on importing Russian oil by sea on December 5, 2022, while simultaneously, the G7 countries set a price ceiling for Russian oil maritime exports at $60 per barrel. An exception is made only for Bulgaria, which is temporarily allowed, until the end of 2024, to continue importing oil from Russia via the Black Sea for its Burgas refinery.

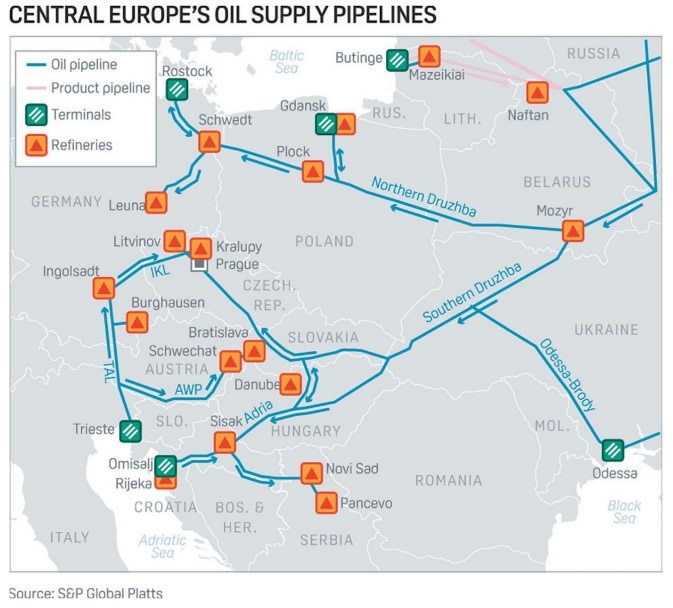

The embargo, de jure, does not apply to the export of Russian oil via the Druzhba pipeline, whose route starts in Russia and then splits into two branches: the northern branch goes through Belarus and Poland to Germany, and the southern branch through Ukraine to Slovakia, the Czech Republic, and Hungary.

However, the Polish state conglomerate Orlen plants and the German oil refineries in Leuna and Schwedt, which received oil via the northern branch, voluntarily stopped purchasing Russian oil at the end of 2022. Concurrently, the German government took companies Rosneft Deutschland GmbH (RDG) and RN Refining & Marketing GmbH (RNRM) into trusteeship under the Energy Security Act. Thus, the Federal Network Agency gained control over Rosneft's subsidiary with stakes in three refineries: PCK Raffinerie in Schwedt (Rosneft's share 54.17%), MiRo in Karlsruhe (24%), and Bayernoil in Vohburg (28.6%).

Rosneft Deutschland is an influential player in the country's fuel market, controlling about 12% of all German refining capacities. The Schwedt plant covers about 90% of the fuel needs of the Berlin agglomeration, and Rosneft effectively lost control over it. The company tried to challenge this decision in a German court but was unsuccessful. Shell and Eni are co-owners of PCK Raffinerie.

How Urals Differs from KEBCO

After refusing Russian crude, the Germans flew to Kazakhstan for oil. The delegation included not only the top managers of the plant but also high-ranking politicians, indicating that the deal was not merely commercial. The negotiations were successful, and in December 2022, KazTransOil sent an annual request to Transneft for the transportation of 1.2 million tons of Kazakhstani oil through the Transneft pipeline system to the oil delivery point Adamova Zastava for further shipment to Germany via the northern branch of Druzhba. Actual deliveries began in February 2023.

Last year, Kazakhstan supplied Germany with 993 thousand tons of oil from the Karachaganak field. Of course, this could not replace Russian supplies – in 2021, before the war started, Rosneft provided the refinery with 17 million tons of oil per year, but, as they say, it’s a start. The application for 2024 is also for 1.2 million tons, but as Minister of Energy of Kazakhstan Almasadam Satkaliyev stated, the federal government has requested to double this to 2.4 million tons.