Exclusive

KAZENERGY National Energy Report: A New Look at Kazakhstan’s Energy Sector

Ruslan Mukhamedov, Deputy Director, Centre for Market Monitoring and Examination LLP

In 2013, KAZENERGY Association decided to prepare a comprehensive document containing information about the current state and growth prospects of Kazakhstan’s oil and gas, coal, uranium, heat and electric power industries. The main goal was to obtain structured data that would provide a clear picture of the situation in the country’s fuel and energy sector (FES), examining the main issues facing the industries within the sector, determining priority measures that need to be taken to address these issues and offering long-term forecasts for the sector’s growth.

As a result, KAZENERGY 2013 National Energy Report was officially presented on January 16, 2014 at the 15th meeting of the Association’s Council: the report was later commended by members of the Association, Kazakhstan’s government officials, as well as a large number of local and foreign experts.

Over the last two years, the world has undergone fundamental changes that have had a significant impact on the economy of Kazakhstan. The global oil price crash has forced many energy producing countries to review their policy on the extraction of natural resources and attraction of investment to the industry.

In this regard, the Association had decided to release a new version of the National Energy Report as part of the preparation for the 10th KAZENERGY 2015 Forum. IHS Energy, one of the world’s leading consulting companies, was invited to participate in the preparation of KAZENERGY 2015 report (hereinafter – the Report) to provide the most objective information about the prospects of the global energy market, the impact of the ongoing processes on Kazakhstan’s fuel and energy sector, as well as ongoing and planned activities aimed at promoting growth in the country’s FES.

Prepared by IHS Energy together with Kazakhstani experts, the Report provides detailed statistical information on all branches of the country’s FES, as well as the analysis of existing systems of government regulation of energy markets (oil, gas, petroleum products, coal, uranium, electrical power and heat), suggesting some comprehensive recommendations on their further development.

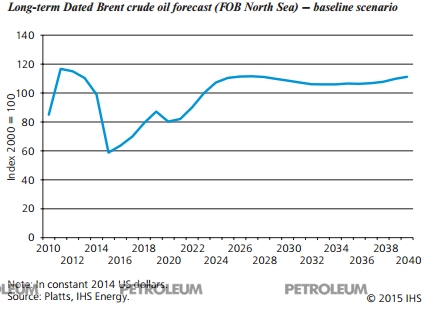

Crude Oil Price Forecast

Crude oil price forecast is one of the most important topics covered in the Report. According to IHS Energy, more than a 50% fall in oil prices earlier this year was caused by both market over-saturation (mainly due to development of unconventional oil resources in North America) and weak demand for energy, as well as Saudi Arabia’s decision not to cut production to preserve its share on the global market.

As a result, it will take time to restore balance in oil markets during which the downward pressure on prices will remain a significant factor, investment in exploration and production will decline, and companies with high-cost production will be forced to reduce oil production.

During this period, which according to IHS Energy will last until at least 2022, prices will be extremely volatile, with the average price of 52 US dollars per barrel (Brent oil) remaining until H2 2016, after which prices will begin to grow gradually, showing an average price of 55 US dollar per barrel in 2016. In the medium term (2017-2020), the average annual price for oil will continue to grow and will reach 79 US dollars.

According to IHS Energy, crude prices will eventually become high again (the average of 100-105 US dollars per barrel during 2021-2040 in 2014 prices), still showing considerable volatility due to supply and demand fluctuations. This growth will result from the fact that even with the current weak growth of world demand for oil, there will be a need to bring more expensive products to the market from unconventional sources, including deep-sea, Arctic and other hard-to-reach oil production projects.

Long-term Dated Brent crude oil forecast (FOB North Sea) – baseline scenario

Long-term Dated Brent crude oil forecast (FOB North Sea) – baseline scenario

Forecast for FES Industries

With respect to the prospects of Kazakhstan’s fuel and energy sector, the most valuable part of the Report are the forecasts for production and consumption of energy based on the IHS global model, which in some cases differ significantly from the forecasts of the Kazakh government agencies and research institutions.

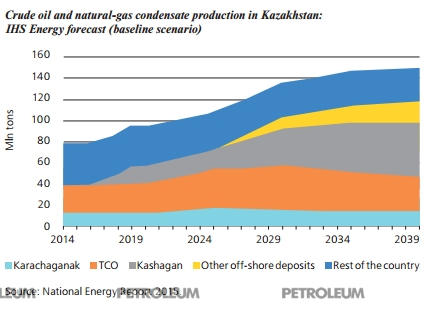

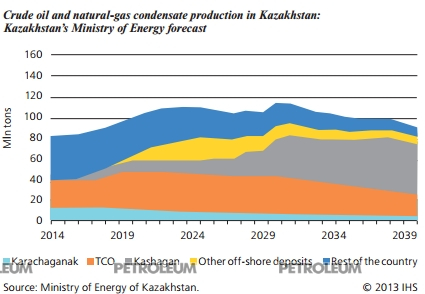

Oil

The Report forecasts that oil production in Kazakhstan will reach 137.1 million tons in 2030 and 150.5 million tons in 2040, instead of 112.7 and 91.5 million tons respectively, as predicted by the Ministry of Energy of the Republic of Kazakhstan.

Crude oil and natural-gas condensate production in Kazakhstan: IHS Energy forecast (baseline scenario)

Crude oil and natural-gas condensate production in Kazakhstan: IHS Energy forecast (baseline scenario)

Crude oil and natural-gas condensate production in Kazakhstan: Kazakhstan’s Ministry of Energy forecast

Crude oil and natural-gas condensate production in Kazakhstan: Kazakhstan’s Ministry of Energy forecast

The most interesting thing here is that the country’s active small deposits have significant potential to increase production. According to the research conducted by IHS Energy, during the 160-year history of oil production, development of only 16% of deposits was ceased completely, primarily thanks to the use of new technologies of enhanced oil recovery. Thus, based on the rest of the world’s experience of production at similar deposits, the Report says that old small deposits in Kazakhstan will remain relevant throughout the entire studied period.

For the country to make this remarkable progress, it needs to implement suggested measures aimed at making the oil and gas industry more attractive for investors and encouraging subsoil users to be go-ahead about enhancing oil recovery. The Report also features a comparative evaluation of investment attractiveness of the oil industry in Kazakhstan and other oil producing countries using the IHS index.

This evaluation shows that Kazakhstan is 11th in the list of 12 countries (regions) chosen because of its relatively heavy tax burden (especially during the period of low oil prices), substantial financial commitments of investors in the early stages of the project cycle, as well as frequent and significant changes in the country’s tax regulations.

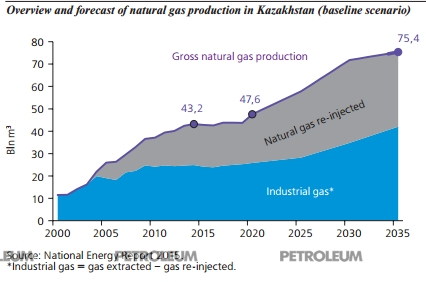

Natural Gas

It is no secret that the majority of natural gas produced in Kazakhstan is associated gas, meaning that its production depends on the production of petroleum. As a result, the gas production forecast contained in the Report also differs slightly from the official estimates. The Ministry of Energy of the Republic of Kazakhstan expects that gross natural gas production will reach 59.8 billion m3 per year by 2030, which is different from 71.8 billion m3 per year predicted by IHS Energy’s baseline scenario.

Yet, IHS Energy agrees with the Ministry of Energy and Kazakhstani experts, who say that opportunities for selling the entire amount of the extracted natural gas are limited due to the high cost of processing associated gas into a marketable product, and also because of the low capacity of the domestic market and poor commercial prospects of large-scale natural gas exports.

Overview and forecast of natural gas production in Kazakhstan (baseline scenario)

Overview and forecast of natural gas production in Kazakhstan (baseline scenario)

As a result, the majority of the natural gas produced during the studied period will be re-injected into the reservoir, while the production of commercial[1]natural gas, according to the Report, will increase up to 26 billion m3 by 2020 and 35 billion m3 by 2030 (according to the forecast of the Ministry of Energy of the Republic of Kazakhstan, the production of commercial natural gas will remain approximately at the current level of about 21-22 billion m3 up until 2030).

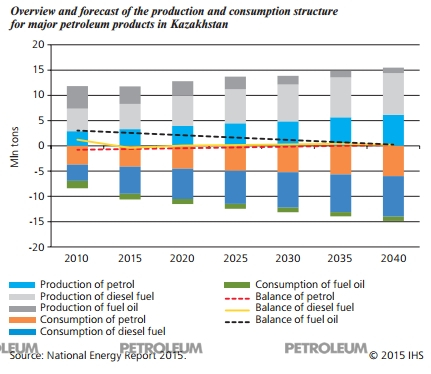

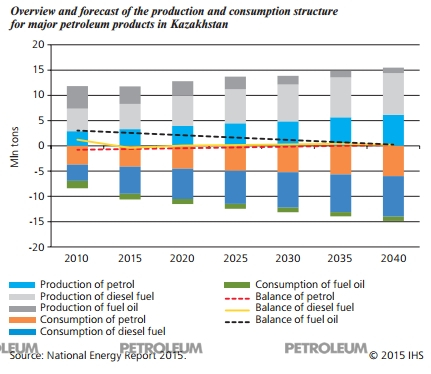

Petroleum products

The Report’s forecast of production and consumption of petroleum products in Kazakhstan is somewhat different. Today, Kazakhstan imports about 22% of white petroleum products it consumes. At the same time, three of the country’s refineries are undergoing modernisation that will help to increase their production to up to 17-18 million tons per year with substantial changes in the product range – with a stronger focus on motor fuel and reduced production of fuel oil.

Overview and forecast of the production and consumption structure for major petroleum products in Kazakhstan

Overview and forecast of the production and consumption structure for major petroleum products in Kazakhstan

The Report says that total domestic consumption of petroleum products will show moderate growth: the aggregate apparent consumption of petroleum products will reach 11.9 million tons by 2020 and 13.5 million tons by 2030, with the current level of 11.7 million tons. As a result, the construction of a fourth major oil refinery, which is currently under discussion in Kazakhstan, may lead to substantial oversupply with fairly limited export potential (the Report covers this in detail in one of the chapters).

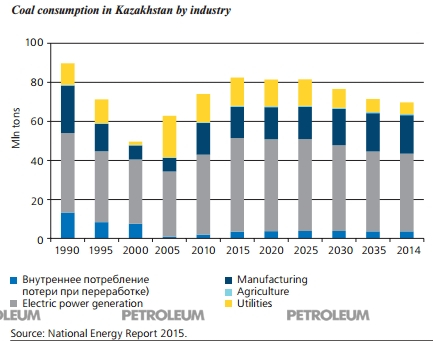

Coal

Coal is the driving force of Kazakhstan’s economy: today, coal accounts for over 60% of the country’s primary energy consumption, and in the long term, it will continue to dominate Kazakhstan’s energy balance.

Previously, about 25-30% of coal was exported (mainly to Russia), but now coal exports to Russia are falling, partly due to its recent economic slowdown. The Report says that Kazakhstan’s coal exports will face challenges (with the exception of certain coal deposits) because of its fairly low quality which makes it less competitive on the global market, and also because the neighbouring countries (such as Russia and China) are taking measures to become energy self-sufficient.

As a result, the Report says that coal production will decline by slightly less than 1% per year during 2015-2040 (from 108.7 million tons in 2014 to about 86.9 million tons in 2040). Apparent consumption will show a similar trend, falling from 82.7 million tons per year in 2014 to about 70 million tons in 2040. During the forecast period, the electric power industry will continue to account for about 60% of the country’s coal consumption, just as it does today.

Coal consumption in Kazakhstan by industry

Coal consumption in Kazakhstan by industry

Electric Power Industry

The Report’s predictions and conclusions about the production and consumption of electricity are just as significant. For example, according to various estimates of Kazakhstani government agencies and institutions, the country will consume about 136-175 billion kWh of electricity per year by 2030, while IHS Energy believes that Kazakhstan will need no more than 111.4 billion kWh in 2030. This is not only because of the observed and predicted economic downturn, but also because the country won’t need as much electricity to support GDP growth, as its economy will become more advanced.

This issue needs to be studied thoroughly, as the construction of new power generation facilities will require large investments. For instance, in the last several years Russia has built up to 20,000 MW of excess power generation capacity based on inflated projections, which is equal to the total installed capacity of all power plants in Kazakhstan. Today, Russia does not need this capacity, yet the consumers still have to pay for it.

Overview and forecast of electric power generation in Kazakhstan

Overview and forecast of electric power generation in Kazakhstan

According to the Report’s forecast structure of generation capacity during the studied period, coal is the primary energy source, with its share declining slightly mostly due to the increased role of natural gas. The Report says that the most significant change in the expected structure of electricity production will result from nuclear power, yet the capacity of renewable energy facilities[2]will show limited growth despite official forecasts and some ambitious plans.

IHS Energy believes that Kazakhstan will continue to treat renewable energy sources as a research project in the foreseeable future due to high costs of wind and solar power for consumers, as well as economic, technical and technological challenges of their integration into the national grid: these technologies will still need constant support from the government and consumers, which is why, according to the Report, they should be mostly developed in areas suffering from energy deficits and located far from the centralised power supply systems.

In this regard, the Report suggests that renewable energy should account for no more than 3-5% of the total electricity production in Kazakhstan by 2030 (15% of installed capacity). However, the Report mentions that the situation with renewable energy may change naturally with the emergence of necessary technology (e.g., highly efficient electricity storage solutions).

KAZENERGY 2015 National Energy Report allows to look at the above and many other issues facing Kazakhstan’s energy sector from a new angle, so it will definitely be of use to government officials in Kazakhstan and foreign countries, commercial, research and non-for-profit organisations and all those concerned with the future of Kazakhstan’s energy sector.

A brief overview of the Report is available on the website of KAZENERGY.

[1]Available for sale and delivery to end consumers, minus the amount of gas used during extraction, storage and transportation

[2]Solar and wind power plants

Published full article