Exclusive

2015: more defeats than victories

The Ministry of Energy of the Republic of Kazakhstan has announces the annual data forthe oil and gas industry. Across almost all key indicators the industry showed a decline compared with 2014, primarily as a result of changed prices, as well as the delay in the launch of theKashagan Field.

Decline in production

In 2015, Kazakhstan produced 79.46 million tons of oil, which – although 0.6% above the plan – isonly 98.3% vs. the previous year’s figure. With nearly 32.3 million tons, Atyrau Region is the biggest producer. It is followed by Mangistau (18.5 million tons), West-Kazakhstan (12.7 million tons), Kyzylorda (8.9 million tonnes), Aktobe (6.9 million tonnes), Zhambyl (18,600 tons) and East-Kazakhstan (900 tonnes) regions.

As usual, Tengizchevroil, Kazakh-American joint venture, is the leading producer with as much as 27.1 million tons produced. Karachaganak Petroleum Operating B.V., the company developing the Karachaganak oil and gas condensate field, produced 12 million tons. Then go KazMunaiGas (8.3 million tons), CNPC-Aktobemunaigaz (4.6 million tons), Mangistaumunaigas (6.3 million tons), Kazgermunai JV (3 million tons), Petro Kazakhstan Kumkol Resources (1.9 million tons) and Karazhanbasmunai (2.1 million tons). These companies collectively account for 87.3% of the country’s total oil and gas condensate production.

After the last year’s dramatic crash in oil prices, the Ministry of Energy had to take a set of anti-crisis measures to support the mining sector. Specifically, five companies in the Aktobe Region (Kazakhoil Aktobe, Aral Petroleum Capital, Caspy Neft TME, Aman Munai and CaspiOilGas) were allowed to burn more gas in August, which helped them to produce additional 300,000 tons of oil.

Exploration time in 46 mineral rights contracts was extended for a period from 1 to 3 years, and a number of contractual commitments were postponed from 2015 to 2016 in 18 contracts. If a company beat its monthly oil production target, it was allowed to export more oil. As a result of joint work with Atameken National Chamber of Entrepreneurs, long-term contracts were signed between 30 domestic producers and 10 mining companies (coal, uranium, oil and gas) for a total of more than KZT 134 billion.

According to experts, oil prices will remain low for at least another two years. In such circumstances, most fields in Kazakhstan will be lucky to break even. Therefore, in February the government reduced its production forecast for 2016 from 77 million tons to 74 million tons. The production is expected to stabilise in 2017, once the Kashagan Field enters commercial service. The growth will also be driven by the expansion projects of TCO and KPO.

Major players

Today, there are a number of multinational vertically-integrated and service companies in Kazakhstan’s petroleum industry, such as Agip, Total, Chevron, CNPC, ExxonMobil, Inpex, Shell, LukArco, ENI and Lukoil.

Three largest deposits – Tengiz, Kashagan and Karachaganak, all operated by consortiums involving multinational companies – account for more than half (52%) of the country’s oil reserves.

Kashagan

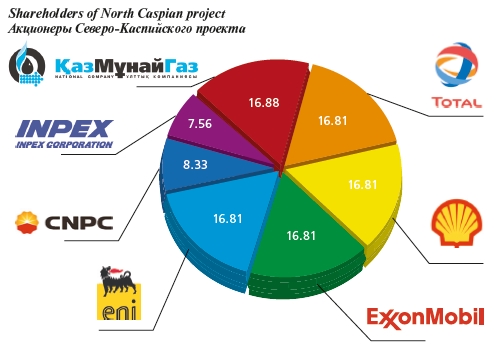

The Kashagan Field is developed under the framework of the North Caspian Sea Production Sharing Agreement of November 18, 1997. Development of the Kashagan Field is currently at Stage I, i.e. experimental development. On September 11, 2013, commercial production began at the Kashagan Field. Because gas leaks were detected on the 28-inch pipeline, production has been suspended since October 2013. Based on the results obtained during in-line and external inspections, as well as laboratory research, the operator and the partners decided to completely replace the oil and gas pipelines between the Bolashak land facility and the offshore complex.