Exclusive

Oil Price: How it Was and How it Will be

Zharas Akhmetov, Galim KhusainovUnited States played down

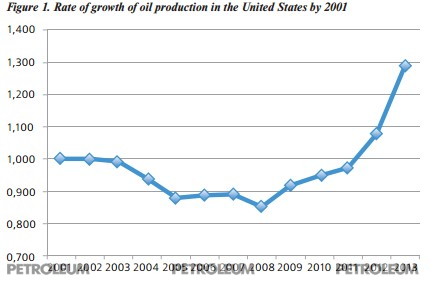

In 2009, at the height of the global financial crisis and the sharp drop in oil prices, a barely noticeable event occurred on the background of global turmoil that determined the current dramatic situation in the world oil market - oil production in the United States began its steady increase (see Figure 1).

Figure 1. Rate of growth of oil production in the United States by 2001

Figure 1. Rate of growth of oil production in the United States by 2001

But this phenomenon had little impact on the movement of world oil prices. Although the United States is the largest importer and refiner of hydrocarbon raw materials, their influence on the pricing was not determinative in the first thirteen years of the new century. If you look at Table 1, you will see that changes in the United States oil industry either did not affect oil prices, or the impact was negligible. It is worth paying attention to negative correlation with the price of imported oil, which indicates that it was not the change of imports affecting the price, but, on the contrary, price changes led to changes in the volume of imports.

We must assume that in the period from 2001 to 2013 China played more important role on the oil market, whose economic growth and, consequently, the growth of oil consumption, was pushing prices up.

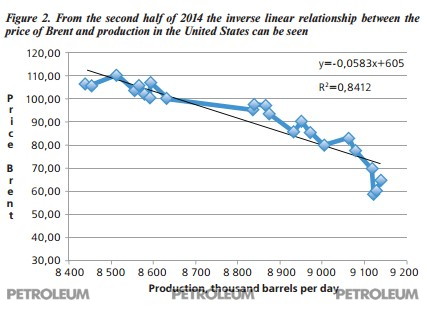

Everything changed in the past 2014 year, more exactly, in its second half - the US oil industry began to determine the price of oil on the world market. The determining factor was the slowdown in the Chinese economy and the problems in the Eurozone. This fact is confirmed by statistical analysis - the correlation between the weekly average price of Brent crude oil and weekly average oil production in the US per day became statistically significant and equal to -0.92. The growth of oil production in the United States pushed oil prices down, as you can see by looking at Figure 2, showing the relationship between oil production in the US and the dynamics of oil prices.

Figure 2. From the second half of 2014 the inverse linear relationship between the price of Brent and production in the United States can be seen

Figure 2. From the second half of 2014 the inverse linear relationship between the price of Brent and production in the United States can be seen

Another important determinant of oil prices in the past year was the strengthening of the US dollar against major currencies - the correlation of the dollar/Euro with oil prices is equal to -0.92. Dollar in the last six months significantly strengthened, particularly to the Euro.

So, the United States played down oil prices in two ways: by increasing production and strengthening the US dollar.

United States, increasing oil production, replaced oil imports from other countries, thus increasing the supply of oil on the market. In 2014, the United States also began to export oil. Accordingly, the excess supply in the oil market, reducing the rate of growth in China and the problems of the Eurozone reduced expectations for demand and oversupply occurred - all this moved prices down.

Analysts believe that the main reason for the return of the United States to the role of ruler of the oil market destinies is the so-called "shale revolution".

"Shale" oil - how to treat it

Shale oil is a light oil of low permeability rocks mined by the multistage fracturing methods or light hydrocarbon fractions obtained by thermal recovery methods on the shale rock with high kerogen content [2]. Shale industry developed in the Soviet Union as well - deposits of the Baltic and the Volga basin (Estonia, Leningrad, Kashpirskoe, Obschesyrtovskoe fields) were developed.

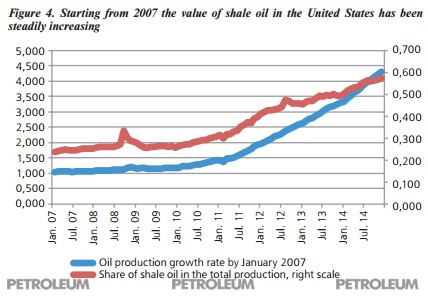

However, it was the US who became leaders in the development of new technologies for the extraction of shale oil. This brought its effect - during the last eight years the shale oil production increased by 4.3 times and it amounts to 58% of total oil production in the United States (see Figure 4).

Figure 4. Starting from 2007 the value of shale oil in the United States has been steadily increasing

Figure 4. Starting from 2007 the value of shale oil in the United States has been steadily increasing

The prospects of the Shfela field development in Israel are not very clear. Its resources are estimated at 34 billion tonnes of oil equivalent. It plans to apply a completely new environmentally friendly and relatively cheap oil shale extraction technology. Today, according to various media reports, the start of development is constantly postponed. However, it shouldn’t be expected that the project will be discarded. Its launch can strengthen downward trend in oil prices.

Price formula

Opportunity to build a statistically significant models became an extra effect of the return of the United States to the role of ruler of the oil market destinies.

A linear regression equation:

Y = -0.0641Х1 – 0.0078Х2 + 780.8909, (1)

where Y - the price of Brent oil, X1 - weekly average production per day in th. barrels, X2 - daily supply of oil to refineries in the United States an average per week in th. barrels, which has good predictive power.

The coefficient of determination R2 = 0.8877, i.e. the selected variables explain 88.77% of changes in oil prices.

The value of F is 90.8873, with F critical equals to 3.4221, indicating a stable dependence of oil prices on the extraction and processing in the United States.

For the corresponding coefficients of the equation the value of t-statistic is equal to: 13.2928; 3.0853; 11.2818. t critical is equal to 2.0687. Accordingly, this means that all the coefficients of the equations are meaningful, not random.

Thus, equation (1) can be used to predict changes in oil prices, of course, if other factors do not intervene.

Another linear regression equation:

Y = 0.1185Х1 – 692.2541Х2 + 584.1645, (2)

where Y - the price of Brent oil, X1 - the daily US oil exports on average per week, X2 - the euro against the US dollar rate.

The coefficient of determination R2 = 0.9162.

The value of F is 125.6992, with F critical equals to 3.4221.

For the corresponding coefficients of the equation the value of t-statistic is equal to: 12.9494; 4.2818; 17.0515. t critical is equal to 2.0687.

As in the case of equation (1), the equation (2) is statistically significant and is suitable for forecasting.

In particular, considering the elasticities, we see that with an increase in the average value of production by 1%, the average oil price will decrease by 6.29 US dollars per barrel; and the increase in the average rate of the dollar against the euro by 1% will lead to a decrease in the average price of oil at 5.97 dollars per barrel.

Accordingly, in order to oil prices began to rise, either of two events shall happen (or both at the same time): reduction in oil production in the United States or other countries, or decrease of the US role in the formation of world prices.

Husainov Galim Abilzhanovich - General Director of BRB INVEST LLC, has experience in the field of investment in various sectors, graduated with honors from the Omsk State University named after F.M. Dostoevsky, Department of Economics.

Husainov Galim Abilzhanovich - General Director of BRB INVEST LLC, has experience in the field of investment in various sectors, graduated with honors from the Omsk State University named after F.M. Dostoevsky, Department of Economics. Akhmetov Zharas Amangeldinovich -Director of OILGASPROJECT LLP, has experience in the field of investment projects in the oil and gas, graduated from the Peoples' Friendship University of Russia named after Lumumba, majoring in Mathematics.

Akhmetov Zharas Amangeldinovich -Director of OILGASPROJECT LLP, has experience in the field of investment projects in the oil and gas, graduated from the Peoples' Friendship University of Russia named after Lumumba, majoring in Mathematics.